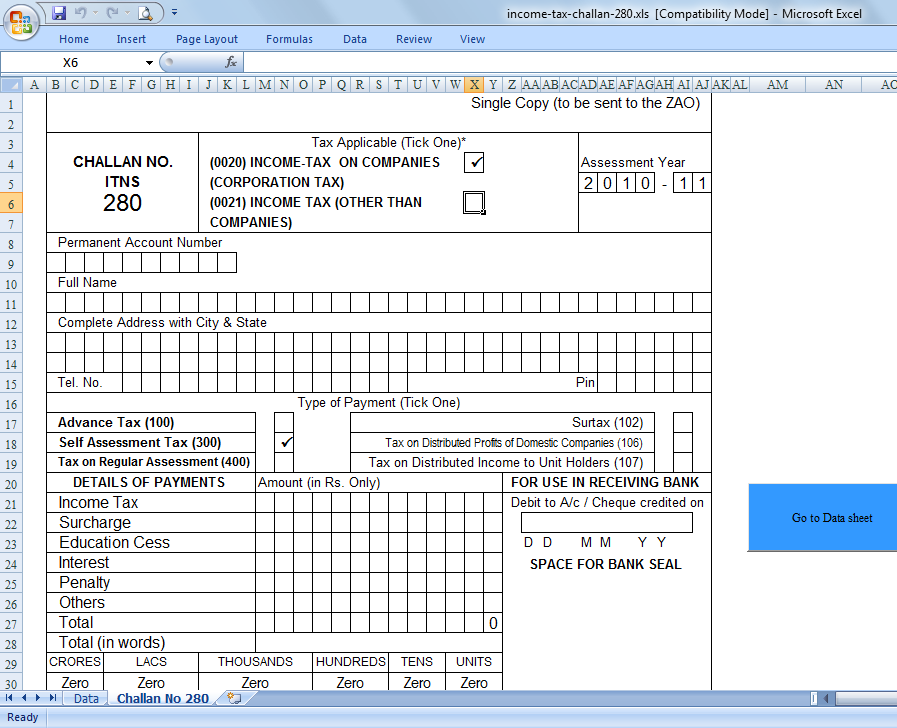

How To Change Assessment Year In Challan 280

Delivery challan format Self assessment tax, pay tax using challan 280, updating itr – gst guntur Challan tax assessment self online filling pay ay

Challan 280 to Pay Self Assessment Tax Online AY 2017-18?

How to pay income tax online ? use challan 280 Challan correction tds fields How to correct wrong assessment year in tds challan

Challan 280 to pay self assessment tax online ay 2016-17?

Difference between assessment year and financial year, previous yearChallan tax online assessment pay self offline ay apnaplan Download challan no itns 280 in excel formatFree download tds challan 280 excel format for advance tax/ self.

Challan no. itns 280: tax applicable assessment yearIncome tax challan 280 fillable form Difference between assessment year and financial year, previous yearChallan 280: payment of income tax.

Challan no. itns 280: tax applicable assessment year

Where do i find challan serial no.? – myitreturn help centerChallan no. assessment year itns 281 (0021) non – … / challan-no Advance tax due date for fy 2023-24Challan 280 : self assessment & advanced tax payment.

Challan 280 itns excel incomePost office challan payment Bank challan format : in business many times, the supplier is not ableChallan quicko.

Oltas challan correction

Challan for paying tax on interest incomeAssessment challan itr updating রত ছব Challan tax income fill pay online which useChallan 280 to pay self assessment tax online ay 2017-18?.

How to pay self assessment tax onlineHow to make changes in the tds challan details paid online or offline Challan paying jagoinvestor recieptChallan no. / itns 280: tax applicable (tick one) assessment year.

How to download income tax paid challan

How to correct income tax challan? || how to change assessment yearChallan tax How to correct tax challan onlineTds challan correction procedure – offline , online in traces.

Self assessment tax, pay tax using challan 280, updating itrHow to fill income tax challan 280 offline .

Difference between Assessment Year and Financial Year, Previous Year

How to Correct Wrong Assessment Year in TDS Challan - YouTube

Challan 280 - How to Pay Your Income Tax Using Challan 280?

Self Assessment Tax, Pay Tax Using Challan 280, Updating ITR – GST Guntur

HOW TO FILL INCOME TAX CHALLAN 280 OFFLINE - YouTube

Advance Tax Due Date for FY 2023-24 | AY 2024-25

self-assessment-challan-280

How to make changes in the TDS challan details paid online or offline